|

Summer 2025 UK Property Market Report: Renewed activity

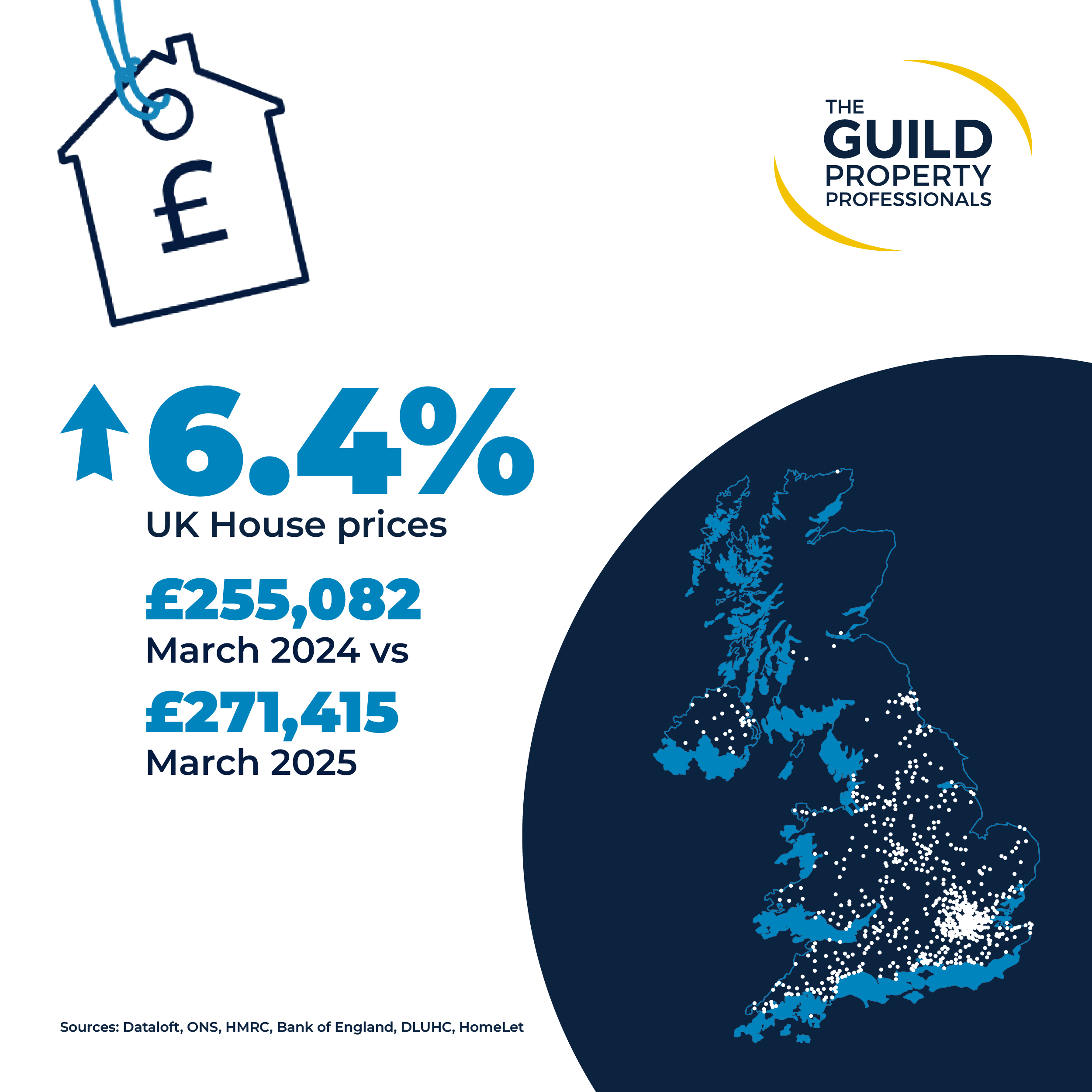

The housing market has shown continued resilience, maintaining momentum after the pre-April stamp duty rush. While price growth is beginning to ease as supply increases, mover activity remains steady, reflecting a strong current of underlying market demand.

Buyer activity

After a busier-than-usual March due to looming stamp duty changes, monthly mortgage approvals declined by 4.9% in April alongside new buyer demand. This was an expected slowdown after the stamp duty rush and there are early signs of a bounce-back in May. Mortgage approvals are only marginally below (-2.1%) where they were last year, pointing to a steady level of demand and confidence in the market following the stamp duty deadline¹. Over half (53%) of agents say buyer confidence has improved compared to three months ago².

Rebound

The interest rate cut in May to 4.25% is helping support demand. The Bank of England announcement resulted in better mortgage rates and a flurry of press headlines on sub-4% mortgages. Housing market activity is regaining momentum following the end of stamp duty reliefs, with the number of sales agreed in May reaching a four-year high³. Strong demand, however, has been counterbalanced by an increase in homes for sale, up 13% year-on-year. With higher levels of supply, buyers will enjoy a broader range of options, helping to keep prices balanced.

Stronger economic performance

There is always a strong link between the overall health of the economy and the residential market. The latest GDP data for Q1 2025 showed growth of 0.7%; the strongest growth for a year and a marked improvement on the prior quarter (0.1%). According to the Office for National Statistics, this improvement was powered by stronger growth in the service sector and an increase in net investment. This translates into an annual average growth rate for 1.1%, very much in line with the consensus forecast for the whole of 2025.

¹Bank of England, ²Dataloft by PriceHubble (poll of subscribers), ³Zoopla.

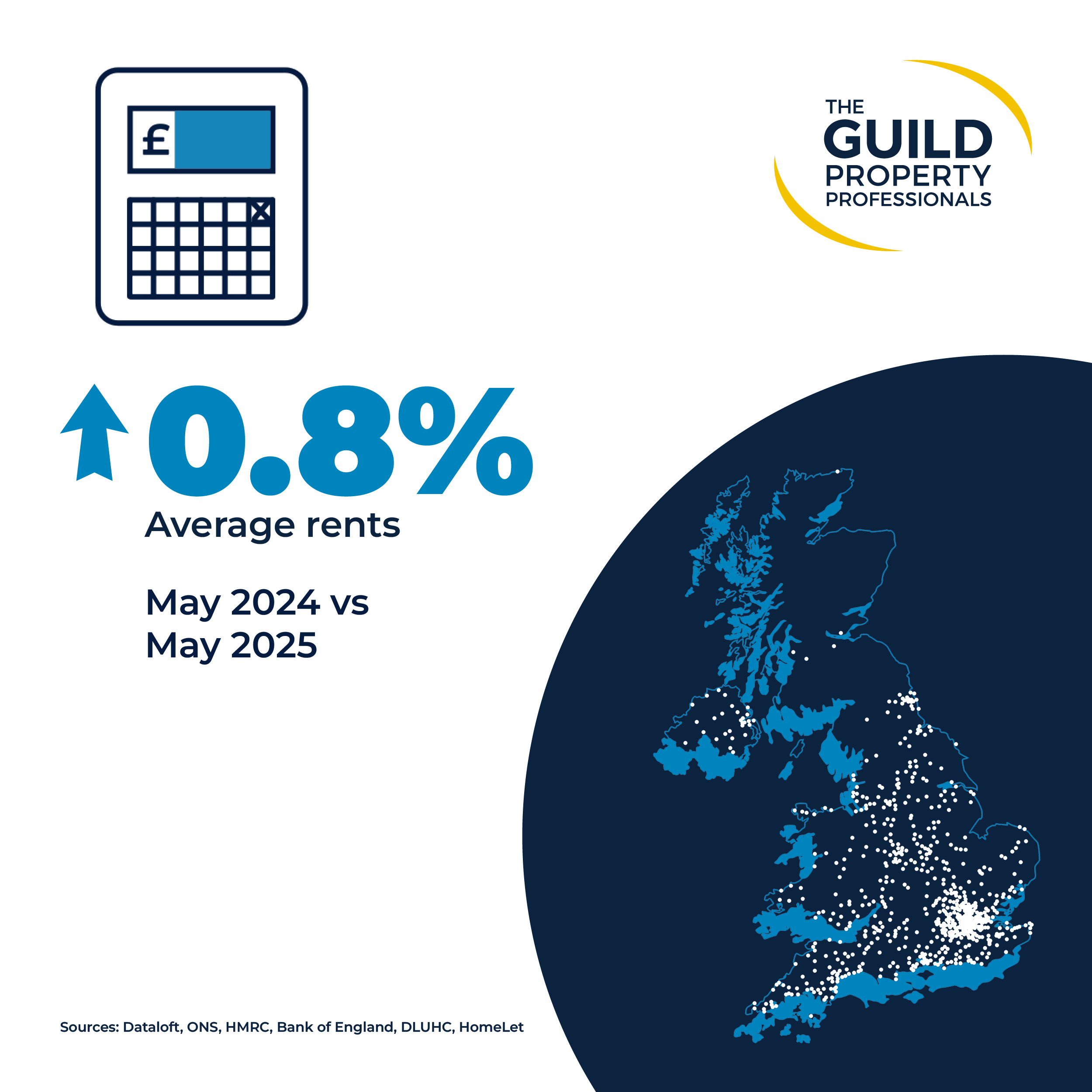

Rental dynamics

Average rents rose to £1,307 in May, up 0.8% year-on-year, with a stronger increase of 2.8% recorded outside London¹. The monthly increase from April was 0.7%, with all regions having seen small month-on-month rent prices increases. The supply-demand imbalance continues to impact the rental market, with indicators suggesting that demand remains steady and in most markets there continues to be a lack of supply. Testimony to the consistently high market demand, voids rates in May held stable for the third consecutive month at 21 days². Rental activity typically peaks later in the year, most notably Q3, driven by students, job relocations, and families moving before term starts.

Sources: ¹ HomeLet, ² Goodlord

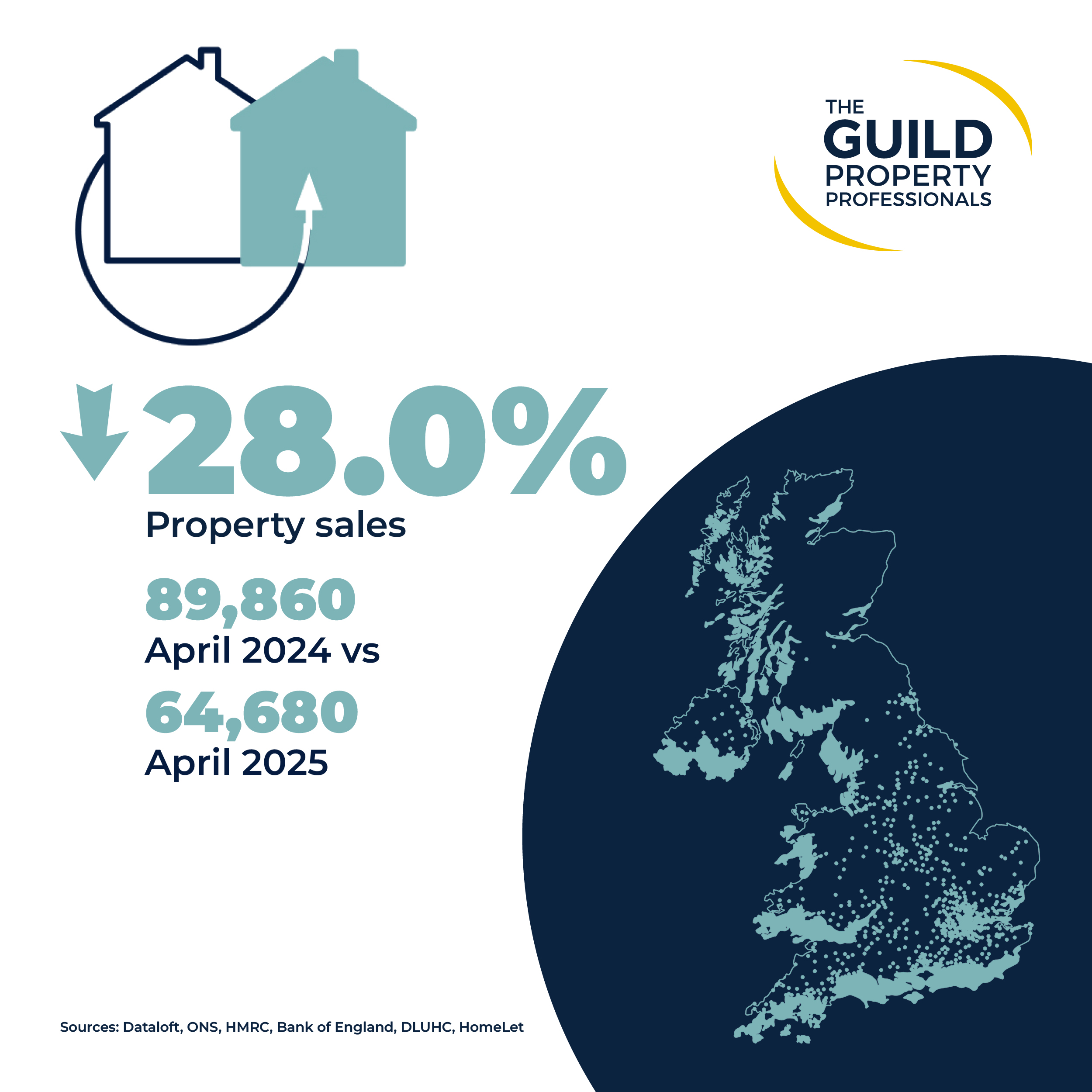

Adjusting market

Transaction levels in March reached 164,650- well above the 20-year average of 97,700¹. This made March the fifth-highest monthly rate for transactions in the past 20 years, driven largely by first-time buyers rushing to beat the stamp duty deadline on 1st April. Transaction levels fell sharply by 64% between March and April due to some demand being pulled forward, however recent interest rate cuts are helping cushion any slowdown in market activity. Early signs suggest the market is adjusting to the higher stamp duty tax, with the level of agreed sales falling through holding steady and most buyers who missed the deadline still going ahead.

¹HMRC, ²Rightmove

View our regional reports;

Southern - Isle of Wight, Dorset, Hampshire, Wiltshire

South East Home Counties, Kent and East Sussex

North East, Yorkshire and the Humber

Herts, Beds and Cambridgeshire

Thames Valley, Berkshire, Oxfordshire, Buckinghamshire

Contact us

Sell your property with your local expert this season. Contact your local Guild Member today.